Arkansas Mileage Rate 2024. The tax tables below include the. This rate is used to calculate.

Your average tax rate is 10.94%. According to an irs statement, starting in 2024, the standard mileage rates for the use of a car (also vans, pickups or panel trucks) will be:

IRS Mileage Rate for 2023 What Can Businesses Expect For The, Cities not appearing below may be located within a county. The irs mileage rate in 2024 is 67 cents per mile for business use.

2024 Mileage Rate Cher Kippie, 67 cents per mile driven for business. Fy 2024 per diem rates for arkansas.

Minimum wage for home care aides is likely to mean bigger raises for, The irs mileage rate in 2024 is 67 cents per mile for business use. How do i get reimbursed?

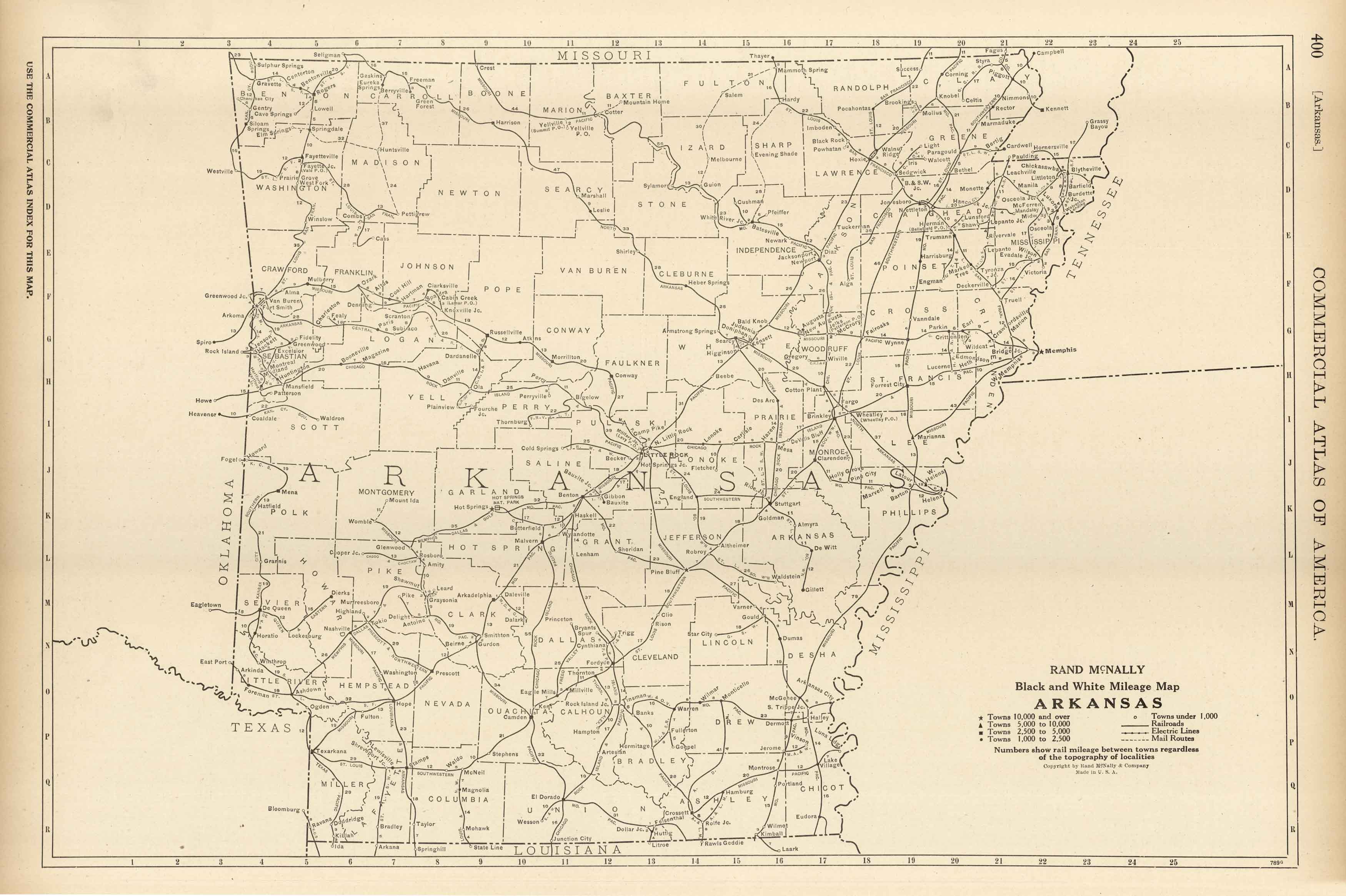

McNally's 1922 Mileage Map of Arkansas Art Source International, The per diem rates shown here for lodging and m&ie are the exact rates set by the gsa for the month of march, 2024. Click on any county for a detailed.

Irs Allowable Mileage Rate 2022, March 2, 2024 at 12:00 p.m. The per diem rates shown here for lodging and m&ie are the exact rates set by the gsa for the month of march, 2024.

New 2022 IRS Standard Mileage Rate Virginia CPA firm, * airplane nautical miles (nms) should be converted into statute miles (sms) or regular miles. Find out when you can deduct vehicle mileage.

IRS Announces the 2023 Standard Mileage Rate, The irs increased the optional standard mileage rate used to calculate the deductible costs of operating a vehicle for business to 67 cents per mile driven,. The rate is increased to 67 cents per mile, up by 1.5 cents from the.

The Standard Business Mileage Rate is Going Up in 2023, Gsa has adjusted all pov mileage reimbursement rates effective january 1, 2024. Fy 2024 per diem rates for arkansas.

Charity Mileage Rate 2024 IRS Zrivo, The irs optional standard mileage reimbursement rate will increase to 67 cents per mile driven for business use, which is up 1.5 cents from 2023. Click on any county for a detailed.

IRS Announces Standard Mileage Rate Change Effective July 1, 2022, How do i get reimbursed? If you make $70,000 a year living in delaware you will be taxed $11,042.

Most inquiries about your assessment, property record, or notice can be best answered by your local county.